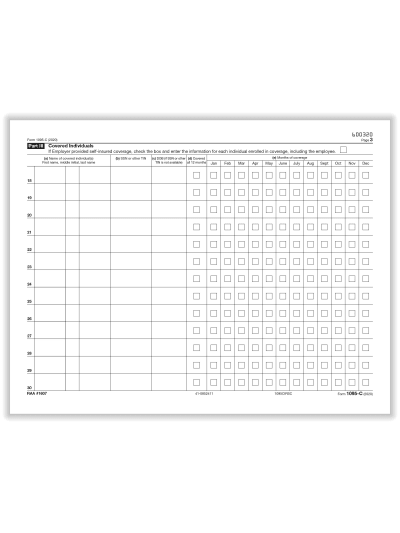

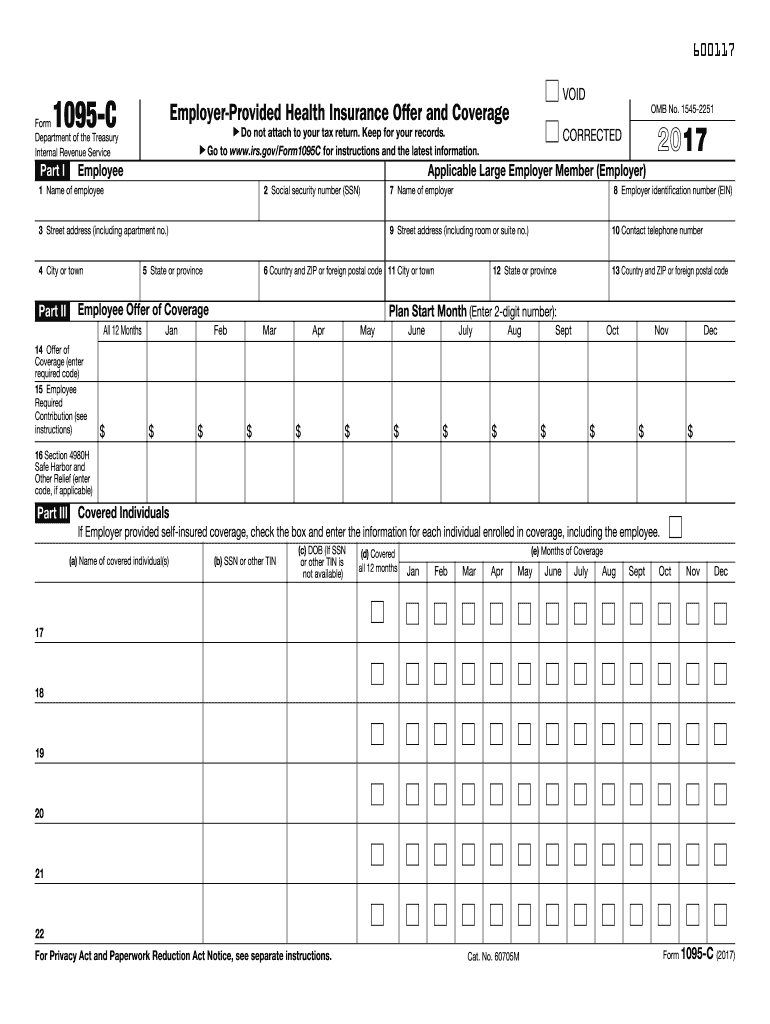

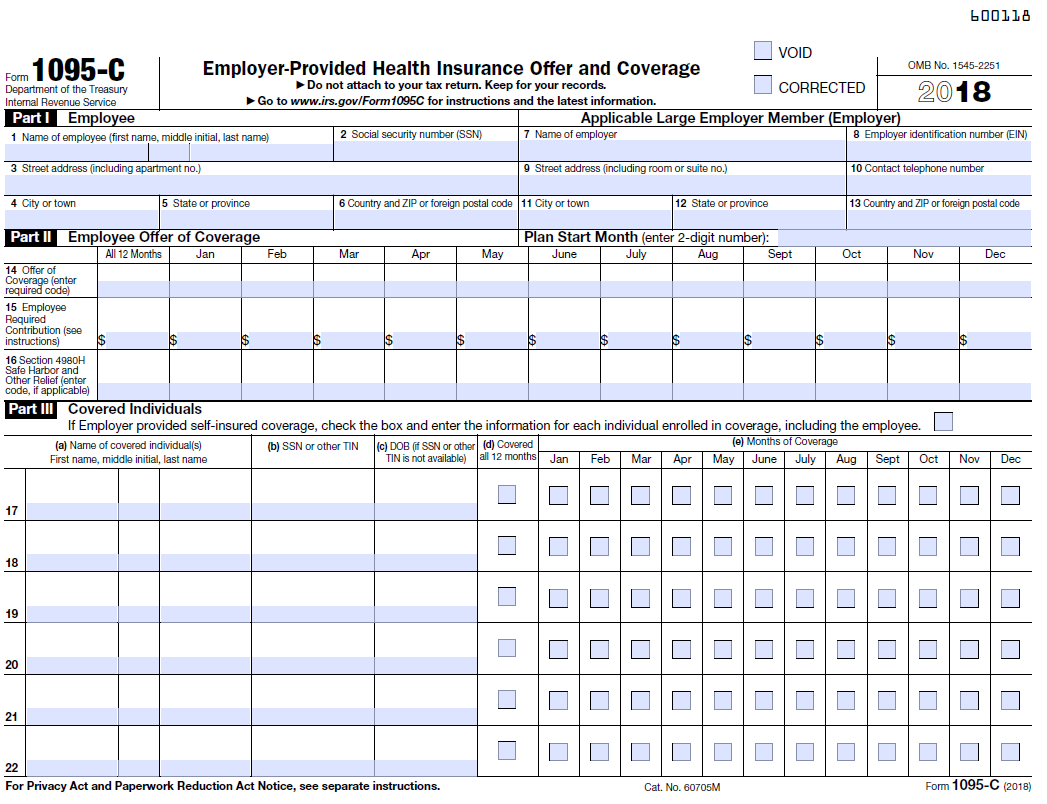

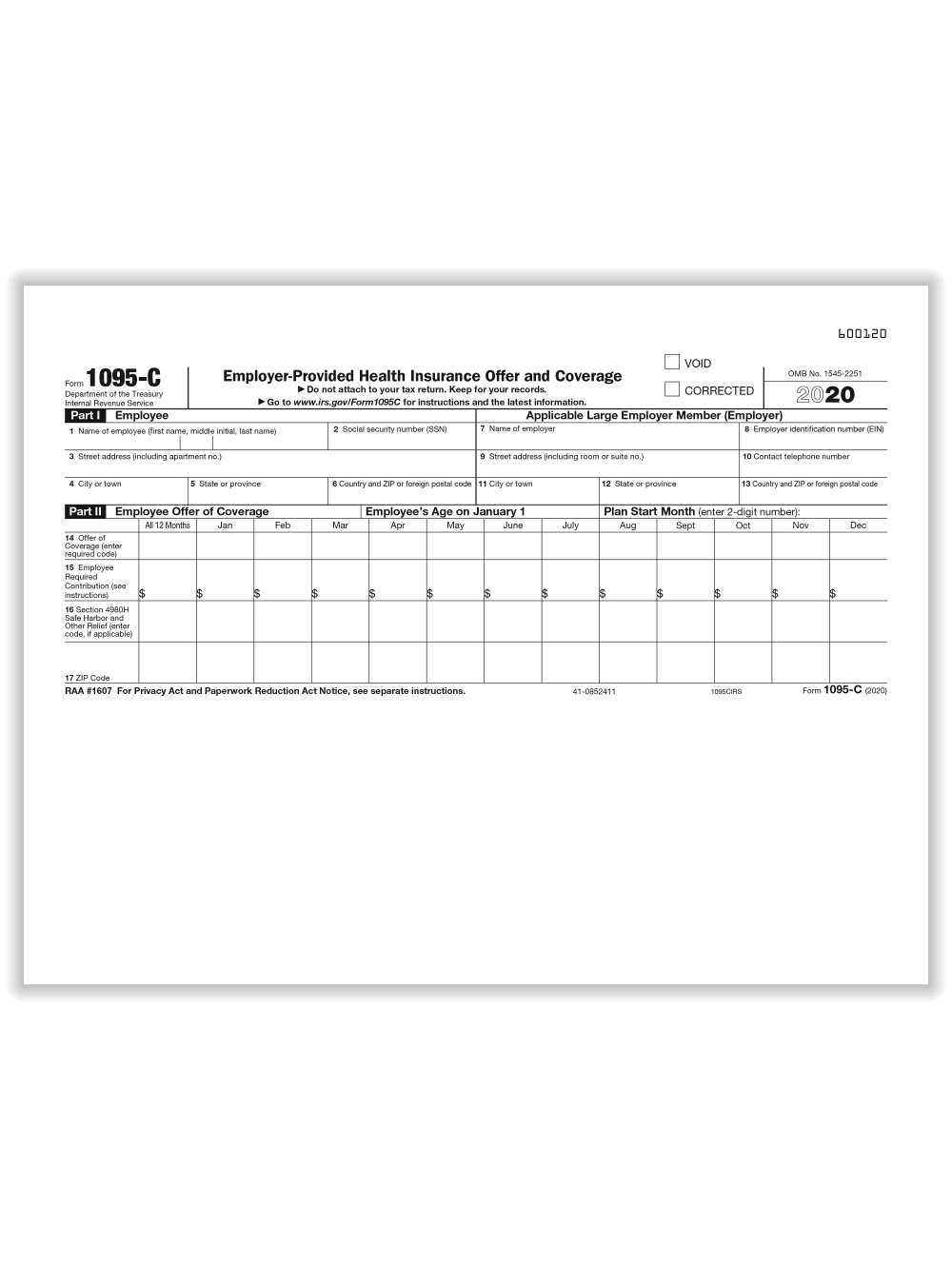

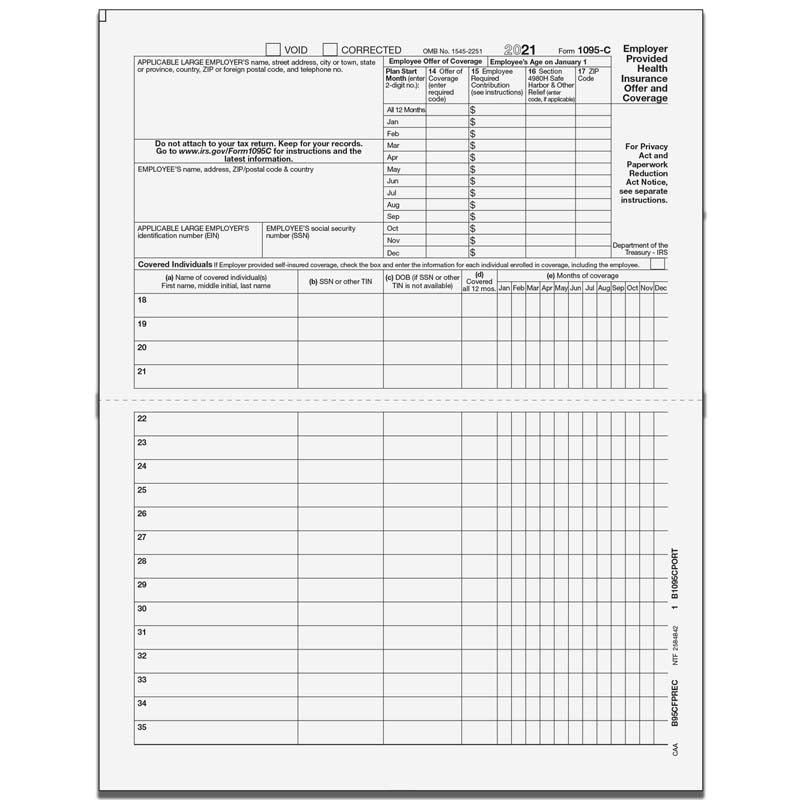

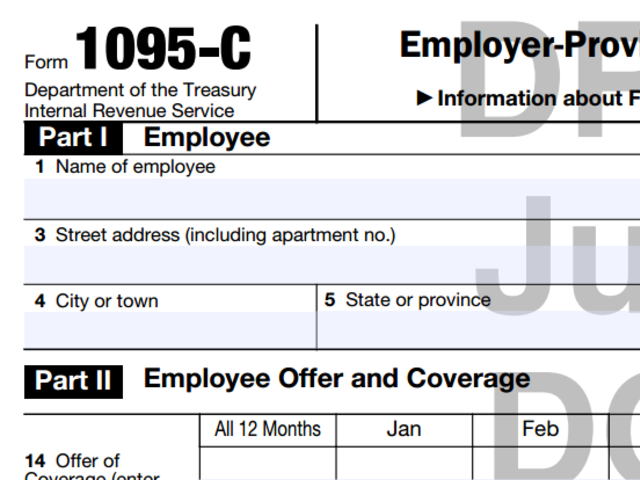

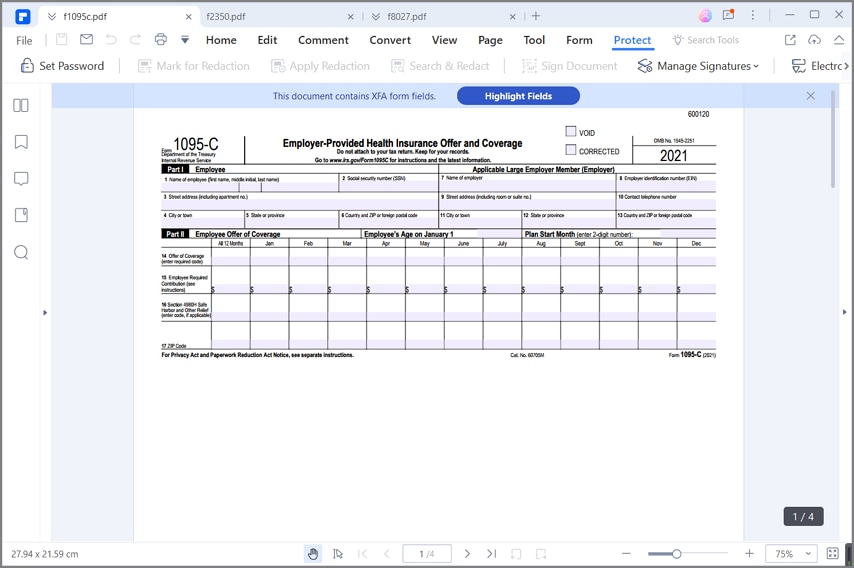

Find 1095 c stock images in HD and millions of other royaltyfree stock photos, illustrations and vectors in the collection Thousands of new, highquality pictures added every dayThe Form 1095C contains important information about the healthcare coverage offered or provided to you by your employer Information from the form may be referenced when filing your tax return and/or to help determine your eligibility for a premium tax credit Think of the form as your "proof of insurance" for the IRS If you or a family member enrolled in healthcare coverage In the month of May, the IRS released a draft version of 1095C & 1095B These instructions are a helpful guide for mandatory ACA reporters who will need to incorporate these changes in their 22 ACA reporting Last year, the IRS mandated the reporting of ICHRA Coverage on Form 1095C by adding the new codes and lines Now, the IRS has released a draft version of 1095C

1095 C

1095 cad to usd

1095 cad to usd- Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paper ALEs filing electronically must file the Form 1094C What is the purpose of ACA Form 1095C?

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

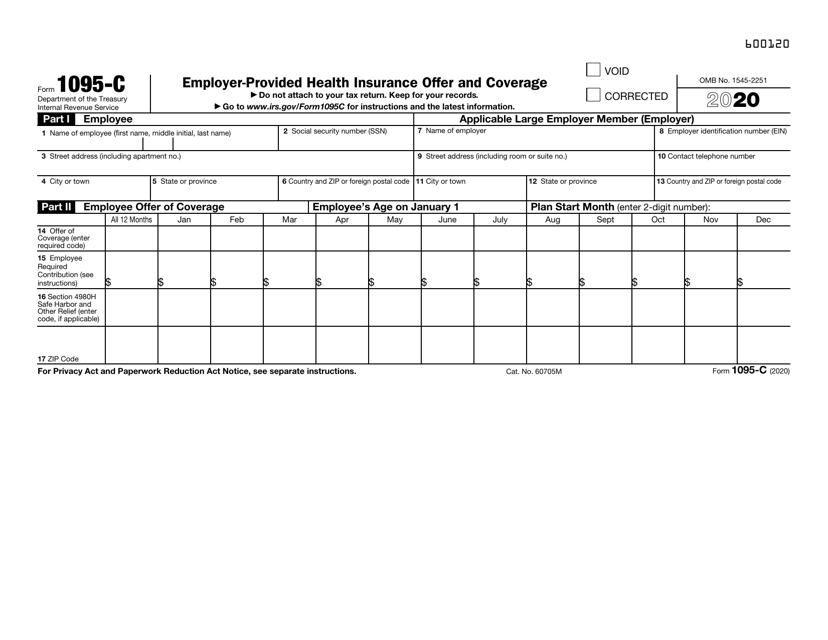

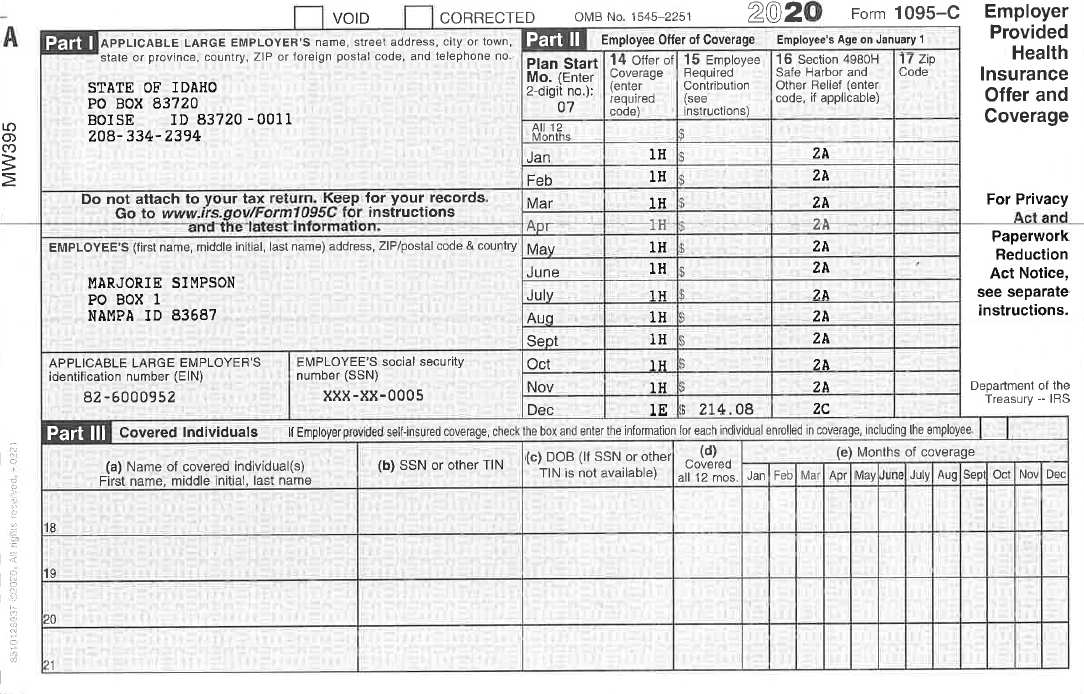

If you have questions about the information on your IRS Form 1095C, or about lost or incorrect forms, you must contact the telephone number provided on your IRS Form 1095C in box #10 The telephone number is 7411 If you are an annuitant who was employed for a portion of , you will also receive an IRS Form 1095C Otherwise, annuitants will not receiveForm 1095C Line by Line Instructions IRS Form 1095C is used by Applicable Large Employers (ALEs) to report the health insurance coverage information provided to their fulltime employees and employee's dependents For the tax year , form 1095C has been updated And, employers should use the updated 1095C form to file with the IRS Form 1095C contains a series of codes that indicate employee health insurance coverage For traditional health coverage, applicable codes include 1A through 1H If using a benefits administration software that automates the Form 1095C process, the software should populate the codes for the months they were enrolled in coverage For filing in 21, the IRS

IRS Form 1095 C Information Form 1095C is an annual statement that employers must provide fulltime employees and those covered by its health insurance plan You can get yours Mailed to your home Please be sure your current mailing address is in Self Service It will be mailed to you by Electronically by logging into Self Service, clicking on Benefits, and then 1095C1095C FAQs This information is applicable to employees of the Commonwealth of Massachusetts, the Massachusetts Bay Transit Authority (MBTA), and the Massachusetts School Building Authority (MSBA) About the Form 1095C The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept withThe Affordable Care Act, Applicable Large Employers (ALEs)1 are required to give each of their fulltime employees a Form 1095C every year, beginning with the 15 tax year They may also have to provide a 1095C to certain parttime employees, depending on the kind of health coverage they provided and if the employee was enrolled in coverage

All fulltime employees at companies with more than 50 fulltime employees will now receive a Form 1095C to report health care coverage offered by their employers There's a new form in town, and its name is 1095C, EmployerProvided Health Insurance Offer of Coverage Much like how you are provided a W2 to reportForm 1095C is for reporting employerprovided health insurance offer and coverage This form provides information employees will need to complete their individual tax returns Employees will show whether they or their dependents had offers for minimum essential coverage They will also show whether they received this coverageIRS Form 1095C is filed with the IRS by the applicable large employer (ALE) who offers health coverage and enrollment in health coverage for their employees Employers with 50 or more full time employees are considered ALEs Employers use 1095C Form to report the information required under section 6056

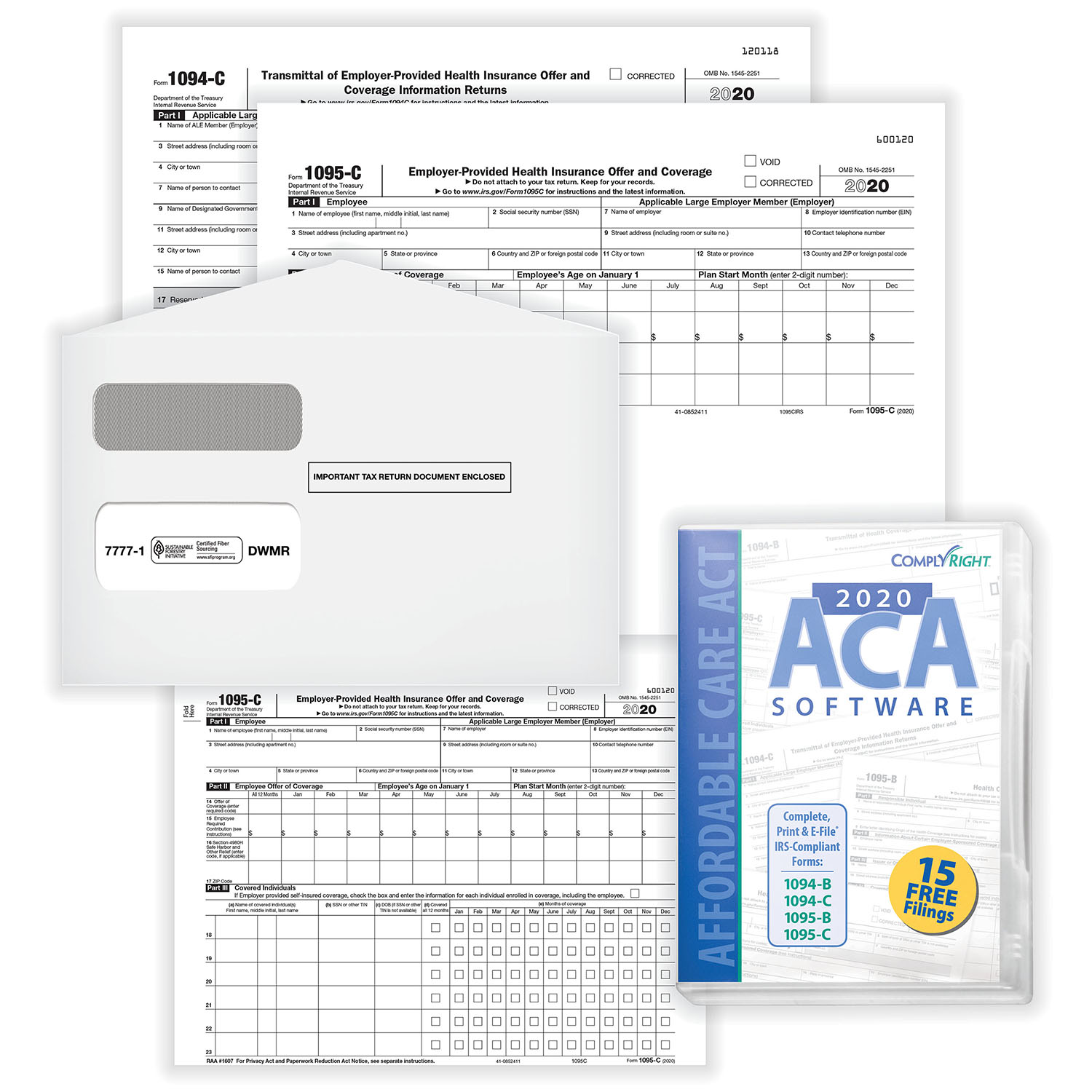

Amazon Com 18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form Landscape Irs Copy Laser Cut Sheet Pack Of 500 1095cirs500 Office Products

Your 1095 C Obligations Explained

The 1095C Form is to report information to the IRS and to employees who have minimum essential coverage under the employer plan and have met the individual shared responsibility requirement for the months that they are covered under the plan You do not need to have a copy of your 1095C in order to file your taxesWhat is the Form 1095C?Did you receive a 1095A, 1095B, or 1095C form this year & wonder what it is & if you need to file it?

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

How To Accurately Complete Lines 14 16 On Irs Form 1095 C

The 1095C template spreadsheet exports from myPay Solutions Direct populated with basic employee information that is formatted to match the Sample 1095C template available in the 1095C spreadsheet import dialog For more information about this process, see Creating an ACA datasheet template Entering information in the spreadsheet1095C If you and/or your family receive health insurance through an employer, the employer will provide Form 1095C by early March 21 However, you don't have to wait until then to file your return as you might get your information in a different way from your employer The form is informational and is used to report whether they offered Forms 1094C and 1095C are used in combination with the IRS automated Affordable Care Act Compliance Validation (ACV) System to determine whether an ALE owes a payment under the Employer Shared Responsibility Provisions under IRC Section 4980H

Form 1095 C Forms Human Resources Vanderbilt University

Affordable Care Act Form 1095 C Form And Software Hrdirect

The IRS Form 1095C is a form that reports to the IRS if you had the minimum essential coverage required under the ACA and also which months of the year you had the qualified coverage Why is it so important to prove I had minimum essential coverage? The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment IRS Form 1095C, "EmployerProvided Health Insurance Offer and Coverage," is a document your employer may have sent you this tax season (or will be sending you soon) in addition to your W2 wage

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Erp Software Blog

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

The ACA Form 1095C, EmployerProvided Health Insurance Offer and Coverage is used by applicable large employers (Employers with 50 employees) to report their employees' health coverage information withThe new Form 1095C requires a large amount of information that employers must track throughout the calendar year Forms must be sent to employees annually by January 31 Companies with more than 250 employees are required to electronically file copies with the IRS and submit a transmittal Form 1094C by March 31The Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form (s) as a part of your personal tax filing

Aca Update Form 1095 C Deadline Extended And Other Relief

Form 1095 C Guide For Employees Contact Us

Find us at https//wwwbernieportalcom/hrpartyofone/In , the IRS issued a few key updates to Form 1095C Now, all applicable large employers (ALEs)Form 1095C (EmployerProvided Health Insurance Offer and Coverage) is given to any employee of an applicable large employer (those with 50 or more fulltimeequivalent employees who worked full time for 1 or more months of the year) Employers who selfinsure must also report on which employees and dependents are covered The Form 1095C provides proof that you were offered Form 1095C merely describes what coverage was made available to an employee A separate form, the 1095B, provides details about an employee's actual insurance coverage, including who in the worker's family was covered This form is sent out by the insurance provider rather than the employer

Benefits 1095 C

Ty Draft Forms 1095 C And 1094 C Released Along With New Form 1095 C Codes Press Posts

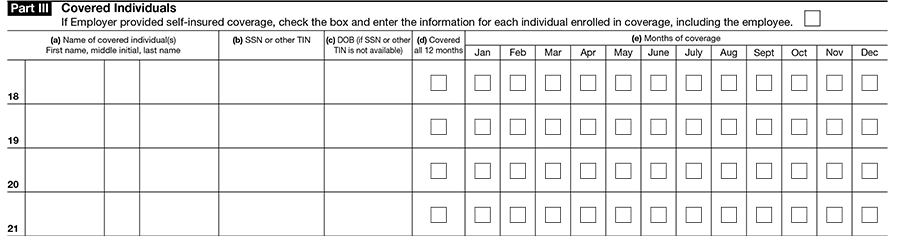

IRS Form 1095C is a statement provided by an Applicable Large Employer (ALE) to each of its employees who were eligible for coverage in the previous year The form helps the IRS enforce the ACA employer mandate by monitoring the type and cost of coverage offered to employees, and the number of employees who were offered this coverage Form 1095C provides details toThe furnace cooling rate is 28 °C/h (50 °F/h) Hardening of 1095 High Carbon Steel Heat to 800 °C (1475 °F) Quench in water or brine The oil quenching section below 475 mm (3/16 in) is used for hardening The hardness after quenching is as high as 66 HRC The maximum hardness can be adjusted downwards by tempering Austempering 1095 high carbon steel responds well toEmployers are required to furnish Form 1095C only to the employee As the recipient of TIPthis Form 1095C, you should provide a copy to any family members covered under a selfinsured employersponsored plan listed in Part III if they request it for their records

Aca And The Vista Hrms Fall Update

Changes Coming For 1095 C Form Tango Health Tango Health

The 1095C Form is to report information to the IRS and to employees who have minimum essential coverage under the employer plan and have met the individual shared responsibility requirement for the months that they are covered under the plan You do not need to have a copy of your 1095C in order to file your taxesForm 1095C EmployerProvided Health Insurance Offer and Coverage is an Internal Revenue Service (IRS) tax form reporting information about an employee's health coverage offered by The forms 1095A, 1095B, and 1095C are health insurance forms for individuals issued by different entities 1095A individuals will get form who purchased thorough Health Insurance Marketplace 1095B these are health coverage outside Marketplace 1095C ( Employer Provided Health Insurance ) individuals who worked fulltime for large companies will

trix Irs Forms 1095 C

What S New For Tax Year Aca Reporting Air

Which employees receive Form 1095C?1095C Form Information This new 1095C Form, related to the Affordable Care Act (ACA), is a certificate of EmployerProvided Health Insurance Offer and Coverage Beginning with tax year 15, this form is required by all large employers to report offers of health coverage and enrollment in health coverage No, the 1095C form just proves that you had health coverage It would not affect your refund as long as you answered the Health Insurance questions accurately You don't need your form 1095C to file your tax return TurboTax will ask you questions about your health coverage but your form 1095C isn't needed Just keep the form for your files If you've already

Standard Register Laser Tax Forms 1095c Irs Copy 50 Sheets Per Pack Sr Direct

1

Here's an overview of these newer ACA formsForm 1095C is filed and furnished to any employee of an Applicable Large Employers (ALE) member who is a fulltime employee for one or more months of the calendar ALE members must report that information for all twelve months of the calendar year for each employee Generally 1095B forms are filed by insurers for employers who use the SHOP, small selffunded groups, and individuals who get covered outside of the health insurance Marketplace 1095C forms are filed by large employers If they are

Irs Form 1095 C Codes Explained Integrity Data

15 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

Form 1095 is a collection of Internal Revenue Service (IRS) tax forms in the United States which are used to determine whether an individual is required to pay the individual shared responsibility provision Individuals can also use the health insurance information contained in the form/forms to help them fill out their tax returns Form 1095C is a tax form that provides you with information about employerprovided health insurance Form 1095C is sent out to those who enrolled in a health plan through the Health Insurance Marketplace In 21, you will be furnished with a Form 1095C reporting the information you need to know about the plan you enrolled in The purpose of Form 1095C is to provide you the information you need to know about claiming the premium tax credit

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

What Is Form 1095 C And Do You Need It To File Your Taxes

A 1095C is also required for any employee enrolled in a selfinsured plan throughout the reporting year For more information see, IRSgov Instructions for Forms 1094C and 1095C Avionté will produce a 1095C for any employee who falls under the below criteria per the data in the Avionté system An employee that reaches ACA fulltime status is indicated by their ACAForm 1095C contains information about the health coverage offered by your employer in This may include information about whether you enrolled in coverage Use the information contained in the 1095C to assist you in determining in you are eligible for the premium tax credit If you enrolled in a health plan in the Marketplace, you may need the information in Part II of Form 1095C An ALE must furnish Form 1095C to fulltime employees and employees covered under a selffunded health plan Accurately completing 16, along with Line 14, of Form 1095C is the most difficult part of the form preparation Line 16 is used to identify specific situations applying to employees which may impact either the employer's need to offer health coverage or the

What Is Form 1095 C Employer Provided Health Insurance Offer And Coverage Turbotax Tax Tips Videos

Mhsec Com Uploads Photos 17 Form1095 C For1

The Office of the Comptroller will mail paper Forms 1095C (Affordable Care Act) by the end of February Forms 1095B and 1095C should be kept with tax records Do not submit them to the IRS or Massachusetts Department of Revenue To view your Form 1095C inUpdated For Administrators and Employees Any employee who was a fulltime employee of an ALE or AALE for any month of the calendar year, or any employee who is enrolled in an ALE's or AALE's selfinsured health plan, should receive Form 1095C Back to FAQ

Form 1095 And The Aca Office Of Faculty Staff Benefits Georgetown University

Office Depot

1

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1095 C Employer Provided Health Insurance Irs Copy For 21 5098b Tf5098b

Pressure Seal 1095 C Form Ez Fold Discount Tax Forms

17 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Amazon Com 18 Complyright Ac1095e150 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 50 Employees Office Products

Your 1095 C Tax Form My Com

1095 C Form Official Irs Version Discount Tax Forms

Form 1095 C The Aca Times

Irs Form 1095 C Uva Hr

1095 C 18 Public Documents 1099 Pro Wiki

What Is The Irs 1095 C Form Miami University

Affordable Care Act Setup

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer

Payroll 1095 C Information Affordable Care Act Aca

What Payroll Information Prints On Form 1095 C To Employees

Office Depot

1095 C Faqs Office Of The Comptroller

Electing To Receive Your 1095 C And W 2 Forms Electronically 19 Social Security Wage Base Increase

Ez1095 Software How To Print Form 1095 C And 1094 C

Sample 1095 C Forms Aca Track Support

1095 C Sample Hcm 401 K Human Resources

Form 1095 C Adding Another Level Of Complexity To Employee Education And Communication The Staffing Stream

Enroll In Employer Sponsored Health Insurance With Irs Form 1095 C

1095 C Preprinted Portrait Version With Instructions On Back

An Introduction To The Irs Aca Reporting Forms For Employer Reporting

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

1095 C Faqs Mass Gov

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Irs Form 1095 C Codes Explained Integrity Data

1095 C

Common Mistakes In Completing Forms 1094 C And 1095 C

What Is An Irs Form 1095 C Boomtax

1095 C Forms Complyright Software Version Discount Tax Forms

Verify That Names And Social Security Numbers Are Correct For Form 1095 C News Vanderbilt University

1

Employers With 50 99 Ftes Cy15 Aca Returns A Must For Irs Integrity Data

1095 C Submit Your 1095 C Form Onlinefiletaxes Com

What Your Clients Need To Know About Form 1095 C Accountingweb

Control Tables And Sample Forms

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Tax Form Preparation Software 1095 C Software To Create Print And E File Forms 1094 C 1095 C

Free 1095 C Resource Employee Faqs Yarber Creative

Yearli Form 1095 C

Posts Department Of Human Resources Myumbc

Changes Coming For 1095 C Form Tango Health Tango Health

Irs 1095 C 21 Fill Out Tax Template Online Us Legal Forms

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Irs Form 1095 C Fauquier County Va

17 Tax Year Affordable Care Act Reporting

1094 C 1095 C Software 599 1095 C Software

Irs Form 1095 C Download Fillable Pdf Or Fill Online Employer Provided Health Insurance Offer And Coverage Templateroller

Changes Coming For 1095 C Form Tango Health Tango Health

Irs Drafts Of New 16 Forms 1095 C 1094 C Leavitt Group News Publications

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

What Is Form 1095 C Filing Methods Due Dates Mailing Address

Accurate 1095 C Forms A Primer Erp Software Blog

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

Instructions For Forms 1095 C Taxbandits Youtube

Overview Of 1095c Form

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

1

Aca And The Vista Hrms Fall Update

Form 1095 C Basics Best Practices And Hr Compliance Bernieportal

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Form 1095 C H R Block

Irs Releases Form 1095 With Changes For Ichra Plans Health E Fx

1095 C Employer Provided Health Insurance Offer Of Coverage

1095 C Print Mail s

Accurate 1095 C Forms Reporting A Primer Integrity Data

Annual Health Care Coverage Statements

1095 C Continuation Forms For Complyright Software Discount Tax Forms

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

1095 C Form 21 Finance Zrivo

0 件のコメント:

コメントを投稿